The region's long-range plan targets the region's core cities and older suburbs for renewal and revitalization, and advocates for increasing diversity as a way in which to ensure the region’s communities are resilient, inclusive, and vibrant. Communities that offer a variety of housing options, provide walking and bicycle trails, are accessible to transit, and evoke a strong sense of local identity are not only diverse, but they also enable greater resiliency during periods of crisis or change.

In addition to its various studies and analyses, DVRPC also provides numerous tools for the region’s municipalities to invest in smart development, and to reinvest in their communities, in order to fortify and ensure the ongoing and future resiliency of the region.

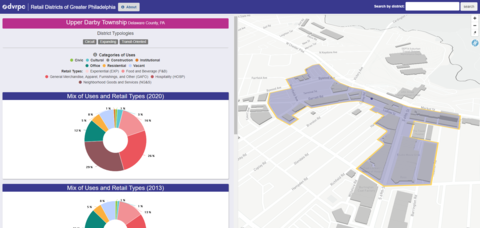

Retail Districts of Greater Philadelphia

DVRPC’s Downtown Revitalization work highlights, and discusses, a variety of evolving issues related to downtowns, main streets, and retail districts. This webmap explores the subtle ways that these various issues impact and manifest across Greater Philadelphia, by leveraging insights gleaned from an inventory of 75 the region’s retail districts, as well as location analytics efforts.

Additionally, Revitalizing Suburban Downtown Retail Districts: Strategies and Best Practices highlights element commonly found among successful suburban retail districts, and outlines short-and long-term strategies to help local officials revive retail districts to further their economic development goals.

Informational Webinars

Adapting to Changes in the Retail Banking Industry

This panel discussion builds upon research and analysis detailed in DVRPC’s report, The Great Consolidation: Community Banking Decline in Greater Philadelphia. The report explored a national shift in the retail banking industry known as the “Great Consolidation,” which is a trend that has implications for everything from household finances and small business growth, to the future of the workforce.

In addition to a presentation by DVRPC staff, the discussion included insights from subject matter experts:

1. Alaina Barca, Community Development Research Analyst, The Federal Reserve Bank of Philadelphia, who discussed her work on defining and mapping the region’s banking deserts;

2. Varsovia Fernandez, Chief Executive Officer, PA CDFI Network, who shared her expertise on the roles that Community Development Financial Institutions (CDFI) play in helping unbanked and underbanked populations access important financial services; and

3. Joseph Tredinnick, Market President with Fulton Bank, who talked about the types of skills that will be needed in the banking workforce of the future.

The Halo Effect

In this webinar, DVRPC staff highlighted findings from a Retail Inventory analysis, which found that a symbiotic relationship existed between the region’s brick-and-mortar retail districts and e-commerce during the pandemic. Within the retail industry, this type of relationship has been termed “the Halo Effect,” which was the focus of the webinar.

In addition to a presentation from DVRPC staff, two expert panelists discussed relevant retail trends, as well as post-pandemic curbside management strategies related to the physical aspect of e-commerce:

Michael Berne, of MJB Consulting, reviewed current retail trends, specifically clicks-and-bricks and the halo effect

Tory Gibler from Fehr and Peers, presented work on post-pandemic curbside management policies, strategies, and tools.

Cultivating Homegrown Economies

Municipal Implementation Tool #34, Cultivating a Homegrown Economy, highlights a societal shift towards greater support for local economies; discusses the benefits to, and challenges of, this trend; and provides examples of specific strategies that the region’s municipalities can implement in order to cultivate their own homegrown economies.

As a follow-up to this publication, DVRPC is hosting a three-part webinar series, with each part focusing on one of the three pillars of sustainability: economic, environmental, and social. Each of these pillars is integral to a successful approach to cultivating a homegrown economy, as well as a key component of both the region’s Comprehensive Economic Development Strategy and the Long Range Plan, Connections 2050.

Follow the links below to register in advance for each of the webinars in this series:

Session 1: Economic Sustainability

Session 2: Environmental Sustainability

Session 3: Social Sustainability

Municipal Tools and Programs

Transportation and Community Development Initiative (TCDI)

TCDI provides grant funding for projects that focus on linking land use and transportation planning by:

- Improving the overall character and quality of life;

- Enhancing the existing transportation infrastructure capacity;

- Promoting and encouraging the use of transit, bike, and pedestrian transportation modes;

- Building capacity in our older suburbs and neighborhoods;

- Reinforcing and implementing improvements in designated Centers; and

- Protecting our environment.

Brownfields / Greyfields

The region's long-range plan prioritizes the reuse and cleanup of underutilized land in the region’s older suburbs and communities. Brownfields and greyfields offer communities the opportunity to diversify their economy and housing options.

Infrastructure Investment and Jobs Act

The Infrastructure Investment and Jobs Act (IIJA), also referred to as the Bipartisan Infrastructure Law (BIL), was signed into law on November 15, 2021. The $1.2 trillion IIJA reauthorizes the nation’s surface transportation and drinking water and wastewater legislation, and includes an additional $550 billion in funding for new programs in transportation, energy transmission, resilience, broadband, and others, approximately half of which goes to the U.S. Department of Transportation over the next five years.

DVRPC provides detailed and up-to-date information on the IIJA webpage.

Breaking Ground Conferences

Breaking Ground is a conference series that DVRPC holds every few years to highlight plan and project implementation throughout the region. Presentations and proceedings from the most recent conference are available on the Breaking Ground webpage.

Pandemic Response and Recovery

The public health crisis caused by the COVID-19 pandemic quickly led to an economic crisis in the days that followed government-mandated stay-at-home orders. The impacts on the region’s retail and service industries, and subsequently the region’s downtowns, main streets, and retail districts, were felt immediately. DVRPC adapted its work to address the immediate needs of the region.

Diverse Downtowns

DVRPC combined data from both the retail district inventory update and location analytics efforts to determine what characteristics were common amongst downtowns where the visitor counts and trade areas were less impacted by the COVID-19 pandemic. The initial analysis was conducted in the winter of 2020 and it was updated with more current location analytics data in the fall of 2021. Overall, the analysis looked at data from the following time periods:

- Pre-COVID-19: August 1, 2018 – March 12, 2020

- Shutdown: March 13 – June 15, 2020

- Reopening: June 16 – October 31, 2020

- Winter Wave: November 1, 2020 – March 12, 2021

- Vaccination: March 13 – June 15, 2021

- Delta Variant: June 16 – September 30, 2021

In general, both of these analyses found that economically, physically, and socially diverse downtowns were typically more resilient than downtowns that were less diverse.

Findings and Takeaways From the Least Impacted Downtowns

- Don’t Put All of Your Eggs in One Basket.

The initial analysis found that greater economic, environmental, and social diversity was related to increased resiliency in the region’s downtowns. The update confirmed that this remained true over the course of the pandemic. Diversity was consistently the number one attribute related to a lower pandemic impact.

- Size Does Matter.

Bigger, more urban downtowns, those with larger residential and employment populations, as well as the total number of uses̵—civic, cultural, office, retail, and residential—were generally more resilient during the pandemic than smaller downtowns.

- Those Boots ARE Made for Walking.

More walkable downtowns, those with fewer vehicles per household and higher WalkScores, were less impacted over the course of the pandemic. This was even more true during periods of high case counts.

- People are Social Butterflies.

Food and Beverage retail establishments, which includes restaurants, breweries, distilleries, and winery tasting rooms, contributed significantly to the overall resiliency of the region’s downtowns. As the share of these types of uses went up in a downtown, the pandemic impact went down. This remained true regardless of the period being analyzed.

- A Little Retail Therapy Goes a Long Way.

As the number of retail uses, and retail’s share of all uses, increased in a downtown, the pandemic’s impact decreased. Additionally, downtowns that were able to attract consumers from beyond the community with a diverse mix of retail types were more resilient while reducing retail leakage. Of interest, the analysis also identified a correlation between greater hobby retail surplus and a lower pandemic impact.

- E-Commerce and Downtowns: A Match Made in Heaven.

Prior to the pandemic, research found that a symbiotic relationship exists between brick-and-mortar retail establishments and their e-commerce presence. In other words, the two approaches to retail complement and reinforce one another. This relationship was termed the “Halo Effect.”

This analysis found that during the pandemic, downtowns where retail establishments had a greater digital presence (e.g. websites and/or social media accounts) were less impacted overall—especially during the periods of lower case counts—than the downtowns where fewer retail establishments had a website and/or social media account prior to the pandemic.

- Different People Make the World Go Round.

Greater demographic diversity was linked with a lower overall pandemic impact. However, during periods of high case counts and low mobility, downtowns with larger Black and/or Hispanic populations were more resilient.

- Transit Goes Both Ways.

Generally speaking, being a transit-oriented downtown—those that are within 1/2 mile of a rail station or trolley stop—had no impact on the overall resiliency of the downtown throughout the duration of the pandemic. However, during periods of high case counts, transit-oriented downtowns were less-impacted. Conversely, these downtowns observed less of a rebound during periods of lower case counts and increased mobility.

- Vacancy Begat Vacancy.

High vacancy rates exacerbated the pandemic’s impact. Similarly, the impact increased as the share of Neighborhood Goods & Services or Civic uses in a downtown increased.

As part of this initial analysis, all 75 downtowns were assigned a Diversity Score and a Pandemic Impact Score on scales of 1—100, with one being the most diverse and least impacted.

The scores for the ten least impacted downtowns were highlighted during the Diverse Downtowns social media, along with factsheets outlining each of the downtown’s characteristics, throughout the spring of 2021. All 75 scores and factsheets were emailed directly to the respective municipalities, and can be found below:

Diverse Downtowns Factsheets

Bucks County

Burlington County

Camden County

Chester County

Delaware County

Gloucester County

Mercer County

Montgomery County

Philadelphia County

Location Analytics

As part of the 5 Ps that Aren’t Pandemic effort, DVRPC identified location analytics as a valuable tool for assisting the region's downtowns in planning for a post-pandemic economic recovery. To understand the pandemic’s impact on visits to and the trade areas of the region’s downtowns, location analytics were conducted for 75 of the region's downtowns.

Below you will find interactive data dashboards comparing visits to and trade areas for each of the downtowns both before and during the pandemic. You can also download a data dashboard comparing 23 former Classic Towns here (please note that you will also need to download Tableau Reader in order to view the file).

Interactive Data Dashboards

Bucks County

Burlington County

Camden County

Chester County

Gloucester County

Montgomery County

Cheltenham Township (Glenside)

Lower Merion Township (Ardmore)

Lower Merion Township (Bryn Mawr)

Philadelphia County

5 Ps that Aren't Pandemic

The 5 Ps that Aren’t Pandemic social media campaign was launched in March 2020. The campaign ran throughout the spring as a way to disseminate information as quickly and effectively as possible during the ever-evolving crisis. Information and strategy recommendations promoted during the campaign were organized into five different categories, or "Ps":

1. Pursue funding from one or more of the many federal, state, county, or local programs aimed at helping small businesses weather the economic impacts of COVID-19.

2. Pivot from your current business model and start manufacturing or selling goods, services, and products that are needed during the pandemic.

3. Pitch ideas on digital platforms to generate interest in and connect you with funding for future product lines or services.

4. Promote your brand online via social media, and maintain a web page for your business in order to generate revenue via e-commerce.

5. Plan not only by developing a strategy to get your business through the current crisis, but also for how it will recover once society and the economy return to a new normal.

Following the campaign, the Strategies for Greater Philadelphia's Retail Districts During COVID-19 Five P's that Aren't Pandemic report was published containing strategy recommendations for how to plan for a post-pandemic economic recovery. Strategies in this report focused more specifically on how traditional brick-and-mortar retail can better compete with the rise of online retail.